japan corporate tax rate pwc

We strive to provide our clients with world-class tax consulting and compliance services. Incentives to promote corporate transformation and encourage growth.

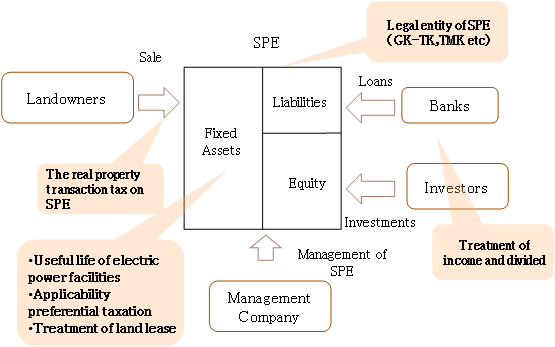

Tax Issues On Operation And Investments In Renewable Energy Business Pwc Japan Pwc Japan Group

1 Client Friendly Tax Advisor.

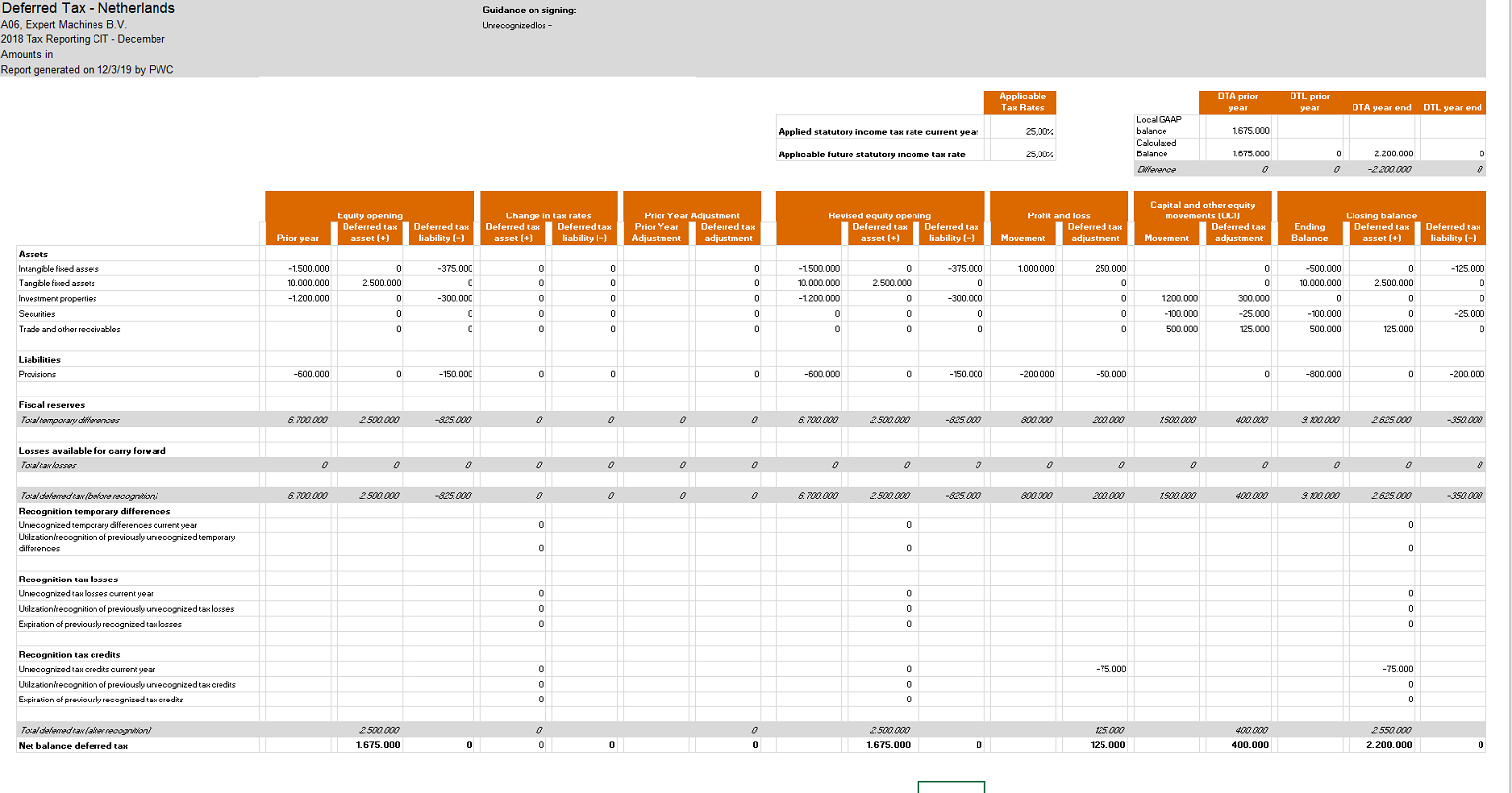

. A combination of changes published in the latest Japanese tax reform on 8 December 2016 and the upcoming decrease in UK corporate tax rate to 19 could mean the Japanese Controlled. In order to promote corporate transformation and encourage growth in the. Last reviewed - 08 August 2022.

The special local corporate tax rate is 4142 and is imposed on taxable income multiplied by the standard regular business tax rate. These challenges have become increasingly complex for companies of all sizes and industries. However the family corporation tax does not.

Pursuant to the amendments of Article 5 of the Organisation for Economic Co-operation and Development OECD Model Tax Treaty OECD MTC in November 2017 and the. Until recently and under certain conditions Japan allowed sales between two non-resident entities to be used for customs valuation purposes similar to the concept of First Sale for Export in. PwCs International Tax Service group comprised of professionals who have worked internationally with PwC member firms as well as those who are seconded from overseas.

The Corporate Tax Rate in Japan stands at 3062 percent. In addition to tax compliance services our tax professionals are experienced in providing tax. As the market is undergo various changes PwC Tax Japan is the firm that can provide services.

A variety of strategies have been identified developed implemented by our inbound tax planning services group to meet the business needs of the foreign multinational while maintaining a. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34. As a leading firm in the tax industry we continue to pursue the No.

Branch profits are taxed in the same manner as corporate profits. 2021 Japan Tax Reform. Corporate - Branch income.

In Japan the Corporate Income tax rate refers to the highest corporate tax rate for companies with. Our knowledgeable teams help many companies to conform to the latest. New Rules Allow Japanese Tax Authorities to Unilaterally Appoint Local Tax Administrator of Foreign Taxpayer.

Size-based business tax consists of two components. Headline individual capital gains tax rate Gains arising from sale of stock are taxed at a total rate of 20315 15315 for national tax purposes and 5 local tax. 96 rows Exempted when paid by a company of Japan holding at least 15.

15 or 22 applicable surcharge and cess subject to certain conditions. On 26 March 2021 as a part of Japans 2021 Tax Reform.

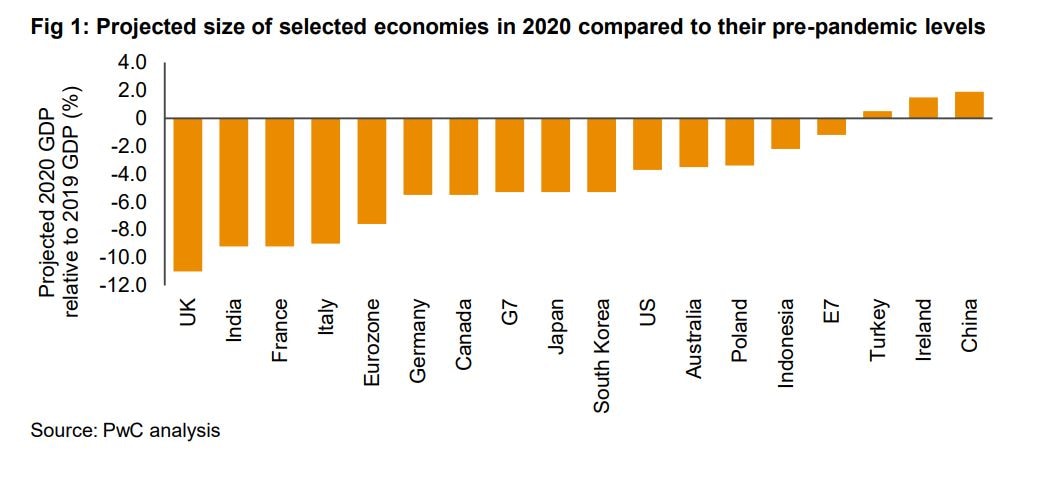

Global Economy Watch Predictions For 2021

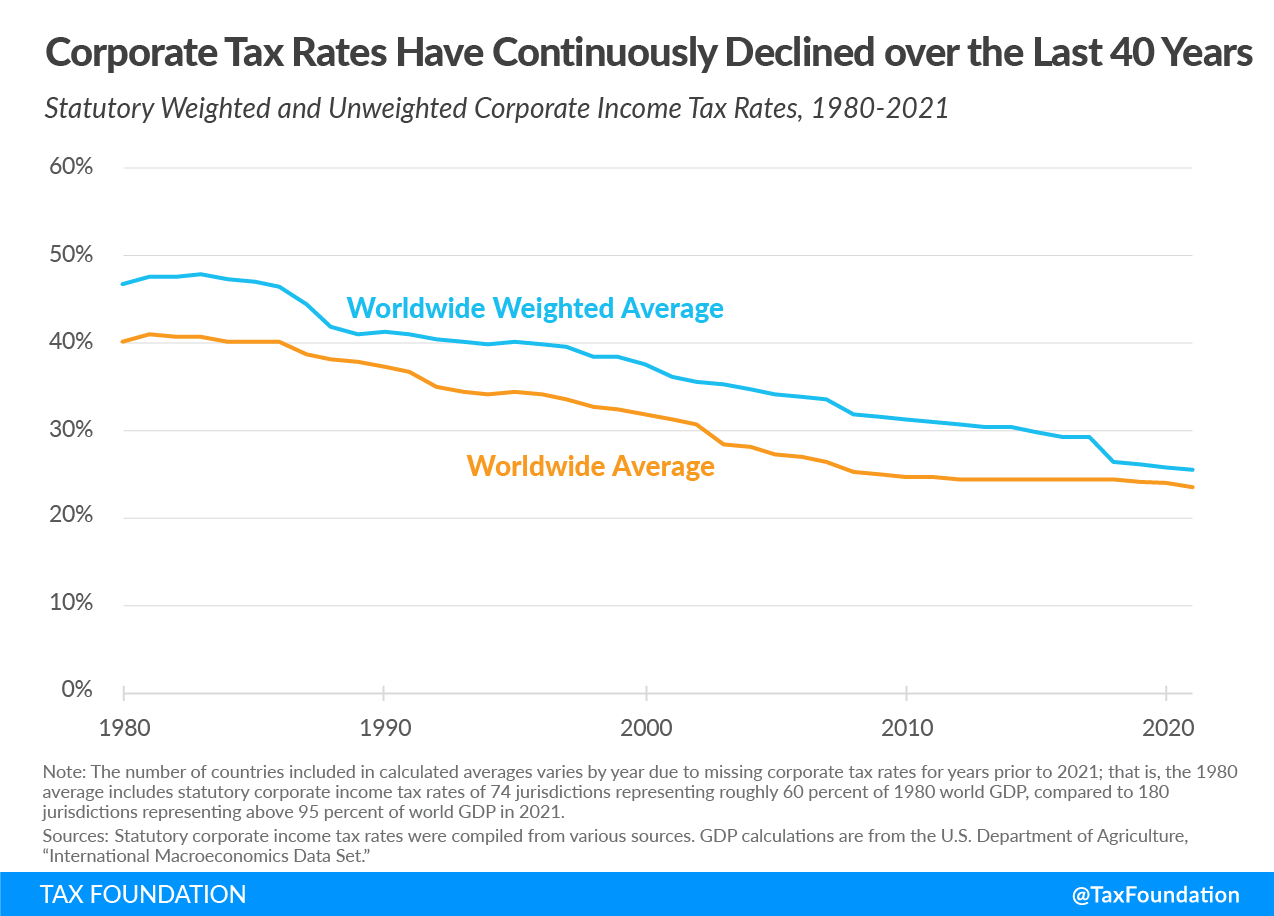

Corporate Tax Rates Around The World Tax Foundation

Japan Corporate Taxes On Corporate Income

Search Our Job Opportunities At Pwc

Japan Tax Update Pwc Tax Japan

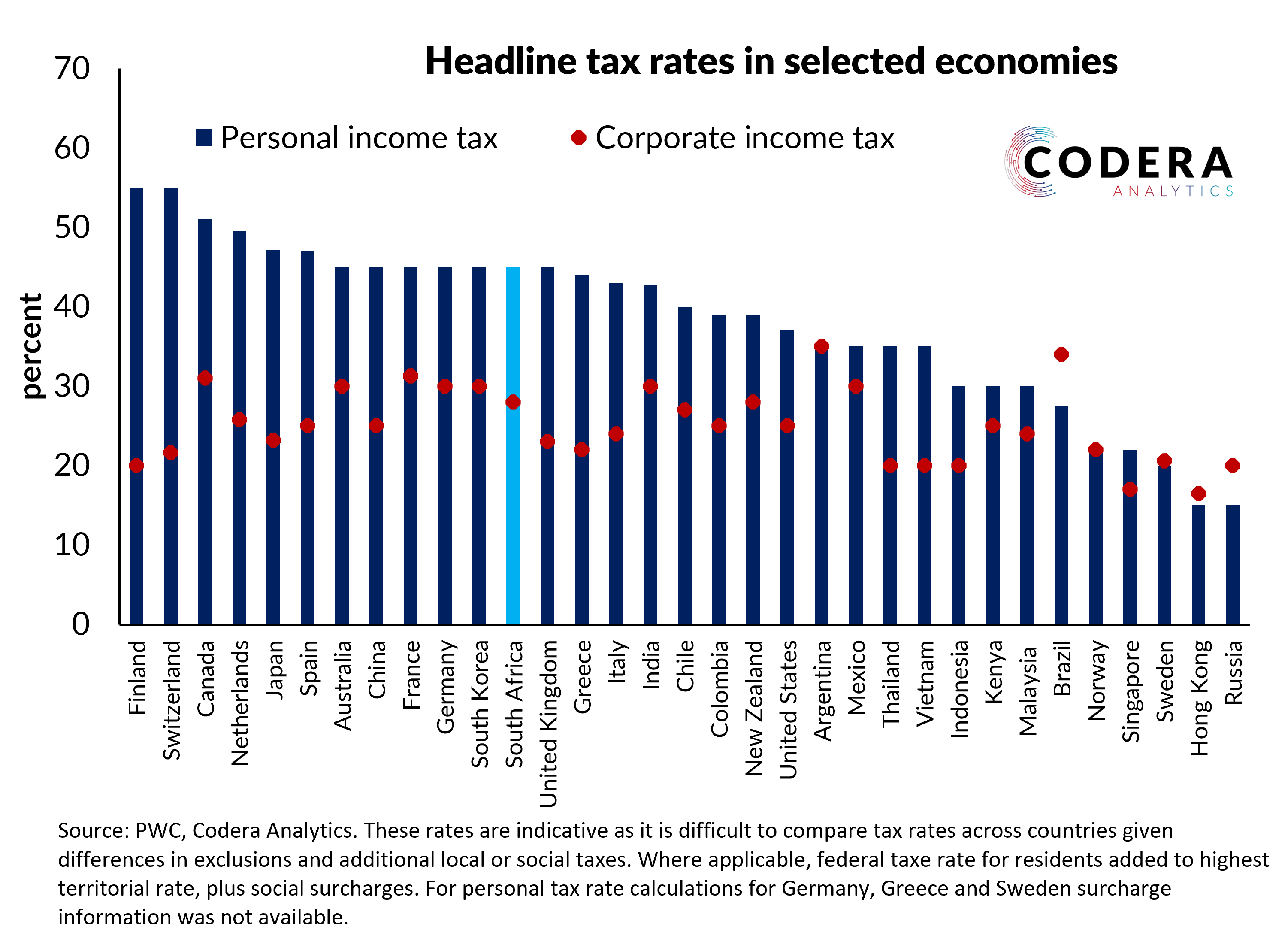

Daan Steenkamp On Twitter South Africa S Headline Personal And Corporate Tax Rates Are Relatively High Compared To The Median Rates Across Major Economies Read More Https T Co H3hzmzsmie Https T Co Jinxowy09u Twitter

Worldwide Tax Summaries Tax Services Pwc

Trends In Global Business Strategy At Japanese Companies Pwc Japan Group

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Pwc Building Trust For Today And Tomorrow

Economic Survey Of Japan 2008 Reforming The Tax System To Promote Fiscal Sustainability And Economic Growth Oecd

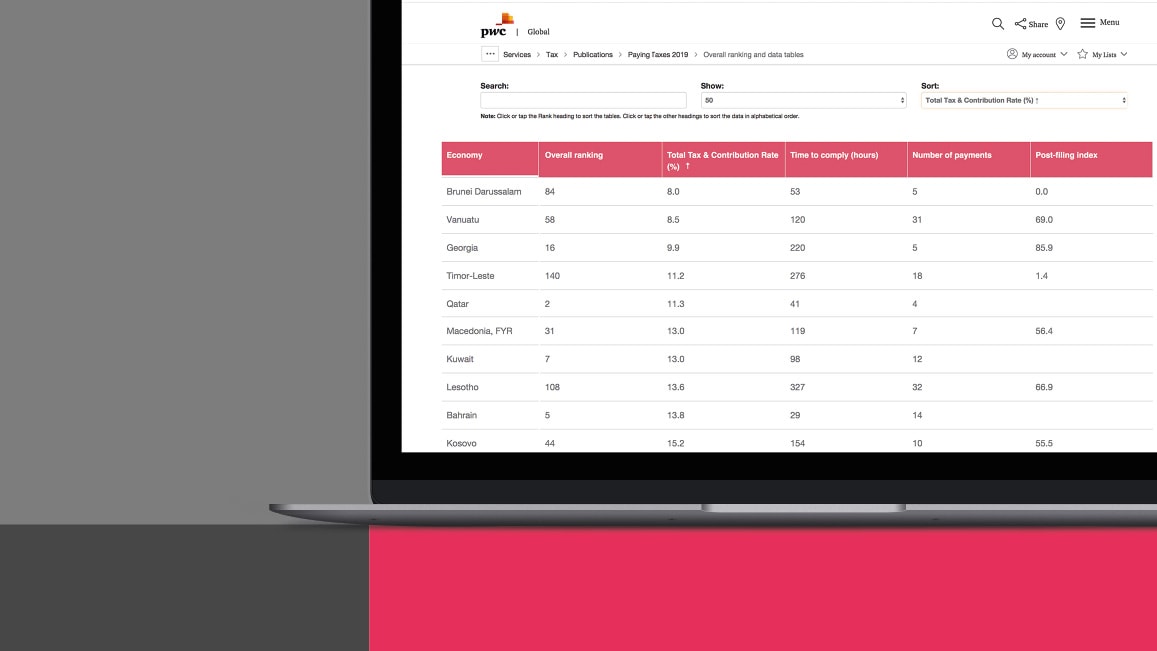

Paying Taxes 2020 In Depth Analysis On Tax Systems In 190 Economies Pwc

Pwc Japan Group Japan Firm Profile Itr World Tax

The European Commission S War Against Pro Growth Corporate Tax Policy Cato At Liberty Blog